Why the Bitcoin–Ethereum Mix Still Matters in 2025

Back in 2009, Bitcoin looked like an experiment. Ethereum’s launch in 2015 added smart contracts and kicked off DeFi, NFTs and most of what we now call Web3. After several boom-and-bust cycles, regulatory crackdowns and institutional adoption, both coins have survived and kept their network effects. That’s why any serious crypto portfolio strategy bitcoin and ethereum still starts with these two. This guide focuses on the practical question most people now ask: not “Should I buy crypto?” but “How much Bitcoin, how much Ethereum, and why?” We’ll keep it conversational, but grounded in risk management, not hype.

Core Ideas Behind a Bitcoin–Ethereum Mix

Before looking at numbers, you need to understand what role each asset plays. Bitcoin is mostly treated as “digital gold”: scarce, simple, and focused on being hard money. Ethereum is closer to a decentralized tech platform, powering stablecoins, DeFi apps and tokenized assets. When you think about bitcoin vs ethereum which is better investment, you’re really choosing between a store-of-value thesis and a growth/innovation thesis. A healthy mix means deciding how much of your conviction sits in monetary revolution versus programmable finance and infrastructure.

Essential Tools You Need Before Allocating

You don’t need hedge-fund infrastructure, but some basic tools are non‑negotiable. First, accounts on at least two reputable exchanges with fiat on-ramps and clear regulation in your region; diversification of venues is as important as coins. Second, a secure non‑custodial wallet that supports both BTC and ETH, ideally hardware-based for larger sums. Third, a simple spreadsheet or portfolio tracker app where you record entries, prices, and target percentages for your bitcoin ethereum portfolio allocation. Finally, enable strong operational security: password manager, unique logins, and two‑factor authentication that is not SMS-based.

Step‑by‑Step: Building Your Core Allocation

Step 1: Define Your Risk Profile in Plain Language

Forget complex formulas at first. Ask yourself three questions: 1) How sick would I feel if this dropped 70% in a year? 2) How many years can I leave this money untouched? 3) Is my main income stable or highly variable? If big drawdowns make you panic‑sell, your crypto slice overall should be small, and your Bitcoin share within it higher. If you’re young, have a long horizon, and can handle volatility, you can justify more Ethereum. Your answers will anchor what “aggressive” or “conservative” really means for you, not for some generic investor profile.

Step 2: Choose Total Crypto Exposure First

People often jump straight to the best bitcoin to ethereum ratio for investment and skip the bigger decision: how much crypto in your net worth at all. In 2025, a common rule of thumb among professionals is 1–5% of liquid net worth for cautious investors, 5–15% for those with high risk tolerance and long horizons. More than that is possible, but it’s speculation, not diversification. Decide this number first. For example, if your investable assets are $50,000 and you pick 6% crypto, that’s $3,000 total to split between BTC and ETH. Only after this step do ratios really matter.

Step 3: Pick a Starting BTC/ETH Mix

Once you know your total crypto amount, you can set a baseline mix. Historically, many conservative investors used something like 70% BTC / 30% ETH. More growth‑oriented investors leaned closer to 50/50. Those deeply convinced in Ethereum’s app layer sometimes flip it to 30% BTC / 70% ETH, but that’s clearly higher risk. There is no universally best bitcoin to ethereum ratio for investment because it depends on risk profile and time horizon. A practical starting point for most people is 60% Bitcoin and 40% Ethereum, then adjust after six to twelve months based on how you sleep at night.

Step 4: Execute Gradually, Not All at Once

Once you’ve chosen a ratio, resist the urge to buy everything in a single day. Both assets are extremely volatile, and perfect timing is fantasy. Break your planned amount into several tranches and use dollar‑cost averaging over weeks or months. For instance, if your target is $3,000 in crypto, you might invest $500 every two weeks until you’re fully allocated. This slows you down emotionally and makes it easier to stick to your crypto portfolio strategy bitcoin and ethereum even when headlines swing wildly. The key is to commit to a schedule and not improvise based on short‑term price moves.

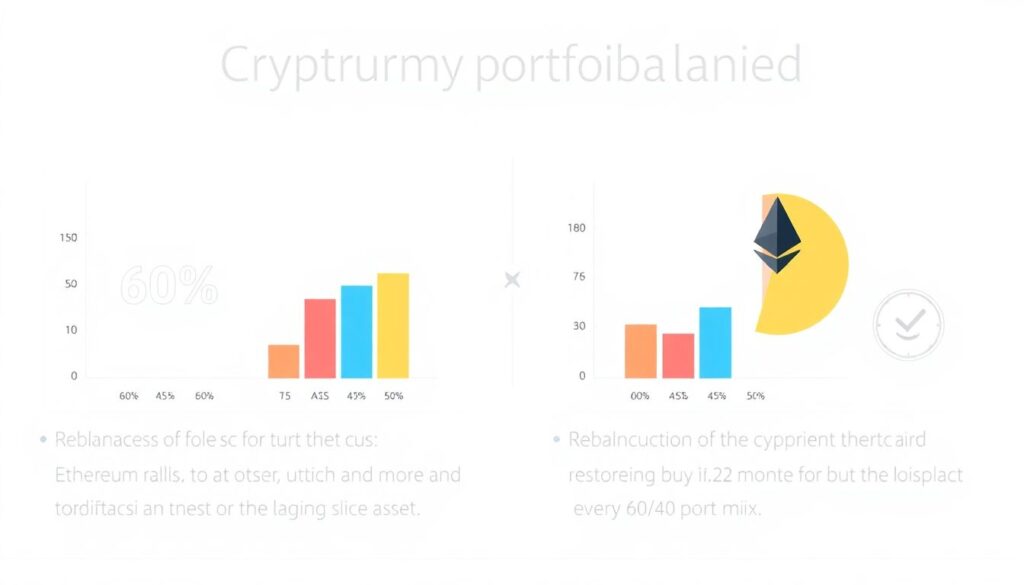

Step 5: Rebalance on a Simple Schedule

After your initial purchases, prices will move and your allocation will drift. If Ethereum rallies harder, your 60/40 might quietly morph into 45/55. Rebalancing means selling a bit of the winner and buying the laggard to restore your target mix. You can do this by time (e.g., every 6 or 12 months) or by threshold (whenever a coin is more than 10 percentage points away from target). A numbered routine like 1) check weights, 2) calculate differences, 3) trade minimally to fix drift keeps you disciplined. There’s no need to micromanage weekly unless you’re a trader.

Historical Context: What Past Cycles Taught Us

Between 2017 and 2021, Bitcoin led the first big adoption wave, but Ethereum quietly captured most on‑chain activity. In the 2020–2021 bull run, ETH outperformed BTC substantially as DeFi and NFTs exploded. Then, in the 2022–2023 downturn, both fell hard, but Bitcoin generally held value better during deep fear phases. The merge to proof‑of‑stake and subsequent upgrades in 2023–2024 lowered Ethereum’s issuance and matured its ecosystem. By 2025, this history suggests why many investors split conviction: Bitcoin for resilience and macro narrative, Ethereum for growth and innovation, rather than betting everything on one storyline.

Using BTC and ETH to Diversify a Crypto Portfolio

If you already own altcoins, the question becomes how to diversify crypto portfolio with bitcoin and ethereum without overcomplicating things. A simple rule is to treat BTC and ETH as your “core” and everything else as “satellite.” For example, you might decide that at least 70% of your crypto value should be in Bitcoin and Ethereum combined, and no more than 30% in smaller projects. When a speculative token moons, skim profits and rotate them back into your core mix. This way, the crazier parts of the market can’t quietly dominate your holdings without you noticing.

Troubleshooting Common Allocation Problems

If You FOMO Into One Coin

At some point, you’ll be tempted to abandon your plan because one coin is “clearly winning.” Maybe a new narrative makes Ethereum look unstoppable, or macro news crowns Bitcoin as the only safe asset. When this happens, revisit your written plan and ask: “What changed in fundamentals, not just in price?” If the answer is “not much,” treat your urge as noise. A useful trick is a cooling‑off rule: wait 72 hours before making any allocation change. If after three days you still think the thesis truly shifted, adjust in small steps, not by swinging your entire portfolio.

If Volatility Keeps You Up at Night

If price swings are wrecking your nerves, your issue is probably position size, not coin choice. Shrink your total crypto exposure—say, from 10% of net worth to 4%—while keeping the same BTC/ETH ratio. This often works better than constantly debating bitcoin vs ethereum which is better investment when the real problem is “too much crypto overall.” Another option is to move a fraction of your holdings into regulated products or custodial solutions with easier interfaces, which can feel less stressful than managing raw wallets, as long as you accept the trade‑off in self‑custody control.

If Gas Fees or Network Congestion Annoy You

On Ethereum, network demand can spike transaction costs, which frustrates newcomers. If this makes you question your allocation, remember that asset choice and transaction route aren’t the same thing. You can hold ETH while primarily using cheaper layer‑2 networks for transfers and DeFi. For Bitcoin, fees can also surge during mempool congestion or inscription waves. The fix is planning: batch moves, avoid rush hours, and don’t shuffle coins unnecessarily. High fees are not a signal that your thesis is broken; they’re a cost of block space that you manage with timing and patience.

Refining Your Strategy Over Time

Your first allocation is a hypothesis, not a lifelong contract. Every six to twelve months, review three things: 1) Have your life circumstances changed (income, dependents, big expenses)? 2) Has your understanding of Bitcoin and Ethereum matured? 3) Has one asset structurally diverged from your thesis? Use this review to gently tilt your bitcoin ethereum portfolio allocation rather than reinvent it. For instance, if you’ve become more convinced by Ethereum’s on‑chain economy, you might nudge your mix from 60/40 to 55/45, not jump to 10/90. Gradual change lets you learn without turning every new idea into a bet‑the‑farm move.

Putting It All Together

To sum up, a practical approach in 2025 looks like this: decide total crypto exposure, pick a starting BTC/ETH mix aligned with your risk tolerance, build the position gradually, then rebalance on a simple schedule while ignoring short‑term drama. Use history as a guide, not as a promise that the next cycle will copy the last. Over time, your experience will matter more than anyone’s model. A calm, rules‑based bitcoin ethereum portfolio allocation beats hot takes and hero trades, and lets Bitcoin and Ethereum do the heavy lifting while you focus on living your life.