Uniswap (UNI): Why the $6.86 Level Is Crucial for Strategic Buyers

Uniswap’s token, UNI, has recently demonstrated a strong upward momentum, particularly after breaking through the $9 threshold. However, the bullish run appears to have paused as the market now faces a corrective phase. Despite the recent surge, technical indicators and market dynamics suggest that a deeper retracement may be on the horizon—making the $6.86 price point a critical level for potential buyers to monitor.

What Triggered UNI’s Recent Rally?

The explosive movement in UNI’s price earlier this week—spiking by an impressive 42% in a single day—was largely driven by a proposal to burn millions of UNI tokens. This initiative is aimed at reducing circulating supply, thereby increasing scarcity and potentially enhancing the token’s value. Moreover, the proposal is designed to reward long-term holders, offering additional incentive for investors to accumulate UNI.

Another factor fueling optimism was the unveiling of the “UNIfication” proposal on November 10, coupled with a planned buyback program. These developments collectively reinforced bullish sentiment and sparked significant trading activity.

Current Market Structure and Technical Outlook

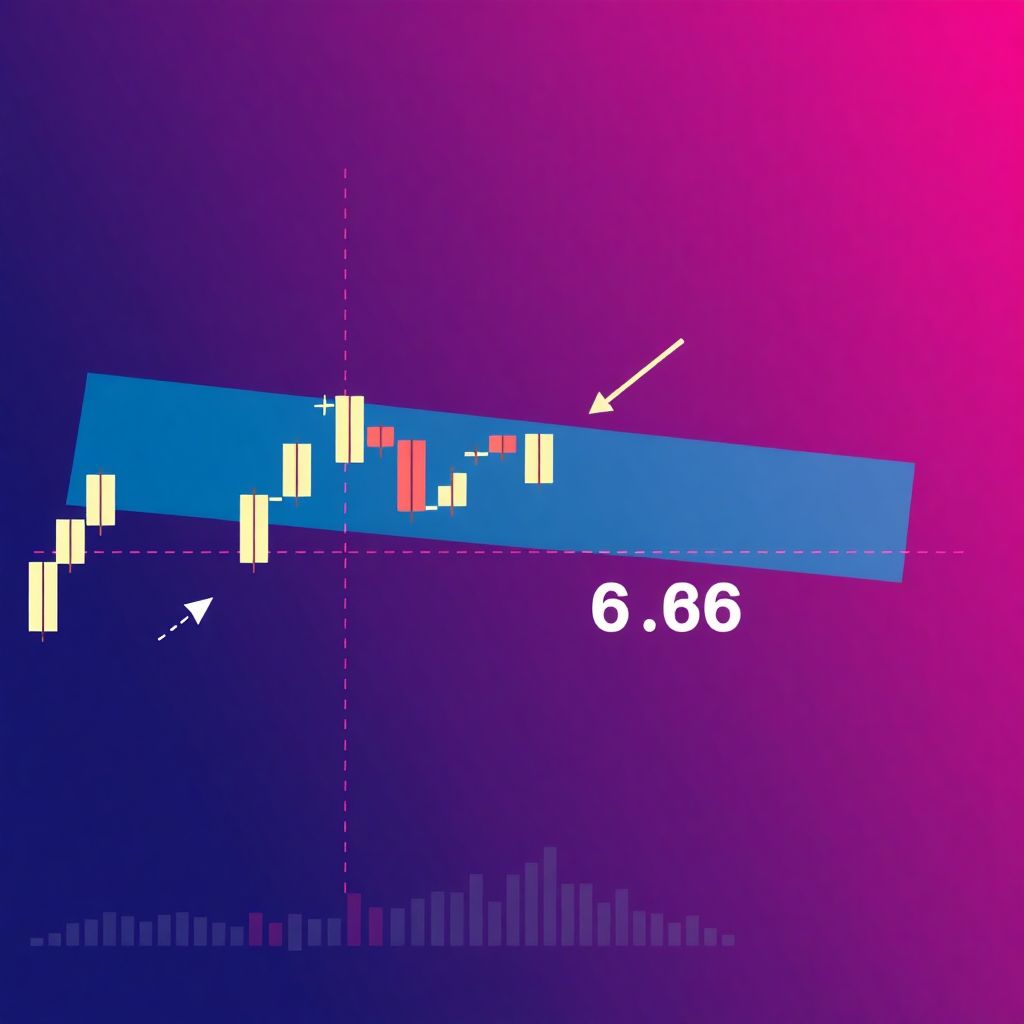

On the daily chart, UNI has re-established a bullish market structure by surpassing the previous lower high at $8.60, indicating a potential trend reversal from the prior downtrend. During the upward move, the short-term resistance at $6.88 offered little resistance, further confirming bullish strength.

However, despite these gains, trading volume indicators are flashing warning signs. The On-Balance Volume (OBV) shows that although there was substantial buying activity during the rally, it has since been countered by strong selling pressure as the price moved past $9. This divergence between price action and volume could indicate weakening momentum.

The Fibonacci retracement tool highlights two potential support zones: $6.86 and $5.92. These levels are likely to serve as key areas for a possible price correction before any further upward movement.

Bearish Pressure Intensifies on Lower Timeframes

Zooming into the 1-hour chart, the decline in OBV becomes more pronounced, indicating that selling activity has dominated over the past 48 hours. The demand zone between $8.10 and $8.50, which previously offered strong support, has now flipped into resistance.

Momentum indicators like the Money Flow Index (MFI) do show a slight uptick, suggesting some buying interest. However, this may not be sufficient to overcome the strong resistance around $8.60. Unless UNI can reclaim this level, the probability of a deeper retracement remains high.

Derivatives Market Signals Weakened Bullish Sentiment

Data from derivatives platforms reveals that Open Interest (OI) and Funding Rates spiked on November 11, aligning with UNI’s price rally. This pointed to a surge in speculative enthusiasm and short-term bullish conviction. However, these indicators have since reversed course.

OI has begun to decline, and the Funding Rate has dropped toward neutral and even entered negative territory briefly—signaling bearish sentiment among traders. This suggests that many long positions are being closed, either due to profit-taking or liquidation, putting additional downward pressure on price.

Why $6.86 Is a Key Level for Strategic Traders

Given the technical structure and deteriorating sentiment indicators, $6.86 emerges as a critical support level. If the price retraces to this point and finds strong buying interest, it could mark an ideal entry for long-term investors or swing traders awaiting a more favorable risk-to-reward setup.

A dip to this level would also align with the 61.8% Fibonacci retracement, a level historically known for attracting demand. If the price stabilizes here and volume begins to rise again, it could present a compelling buy opportunity.

Should You Buy Now or Wait?

While long-term investors might consider starting to accumulate UNI given the project’s fundamental strengths and recent proposals aiming to boost tokenomics, short-term traders may prefer to wait. Entering during a retracement to stronger support levels like $6.86 or even $5.92 could offer a more advantageous position with limited downside risk.

Fundamental Factors Still Favor Uniswap’s Growth

Despite the current technical retracement, Uniswap’s long-term prospects remain strong. The protocol continues to dominate the decentralized exchange (DEX) landscape, and recent governance moves point to a community actively working to enhance sustainability and investor value.

The proposed buyback and burn mechanisms are particularly noteworthy. If successfully implemented, they could introduce deflationary pressure on UNI, improving its long-term value proposition. These measures also show a shift toward more active treasury management—another positive signal for investors.

Market Context and Broader Crypto Trends

It’s also important to consider that Uniswap’s performance doesn’t exist in a vacuum. The broader crypto market has shown resilience, with Bitcoin and Ethereum maintaining key support zones. Should the overall market continue to recover, UNI could benefit from this tailwind, especially if it can hold above its key support levels.

Risk Management and Trading Strategy

For traders, managing risk remains essential. Setting stop-loss orders below $6.86, and potentially below $5.92 for more conservative traders, can help limit potential losses. Conversely, taking partial profits near resistance zones like $8.60 or $9.00 can lock in gains during volatility.

Final Thoughts

While Uniswap has recently enjoyed a strong rally, current indicators suggest caution in the short term. A pullback to $6.86 could offer a strategic entry point for buyers looking for a better risk-reward setup. As always, successful trading requires a balance between technical analysis, market sentiment, and sound risk management. Keep an eye on volume trends, OBV, and macro market conditions to make informed decisions as the UNI price action unfolds.