U.S. banks get green light to intermediate cryptocurrency trades under new OCC guidance

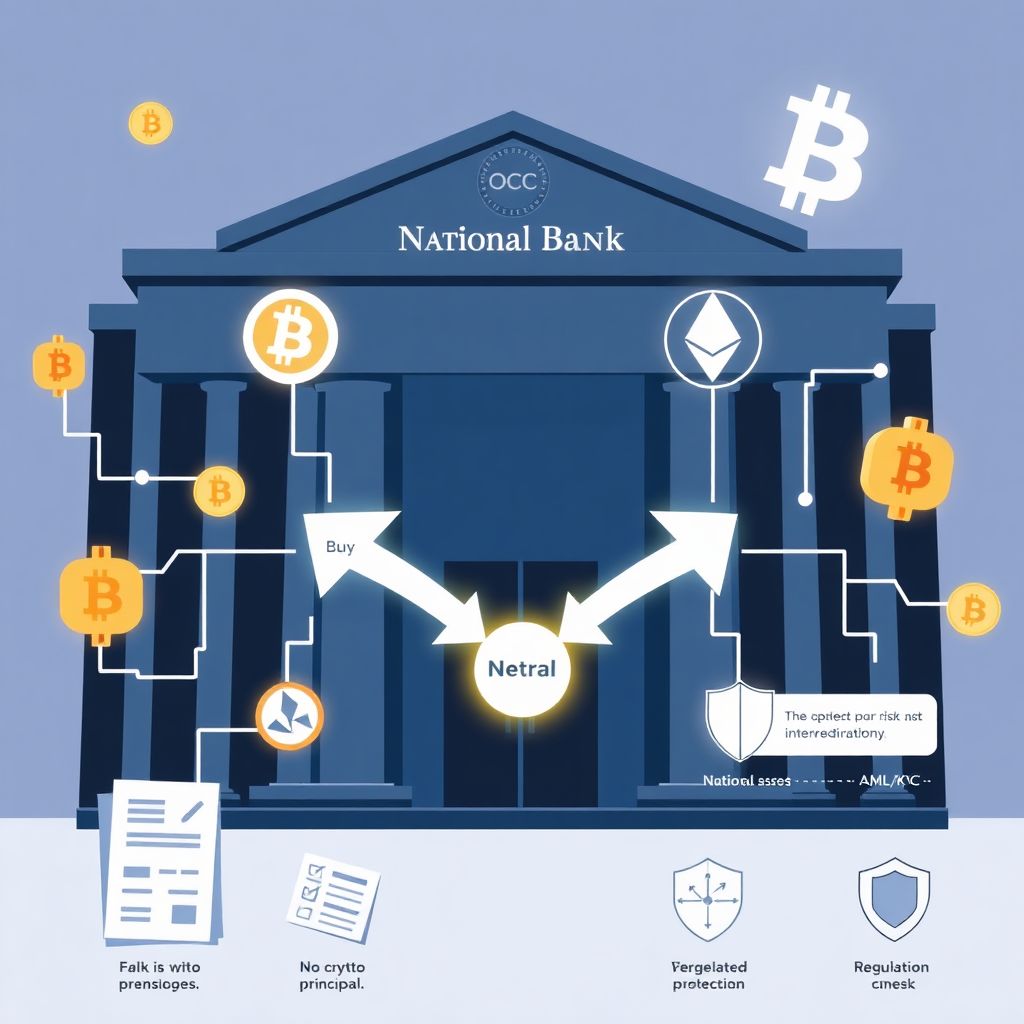

The U.S. Office of the Comptroller of the Currency (OCC) has opened the door for nationally chartered banks to play a more direct role in the cryptocurrency market. In a new interpretive letter, the agency confirmed that banks are allowed to intermediate crypto trades using a structure known as “riskless principal” transactions, a model long used in traditional securities markets.

This clarification could significantly change how mainstream financial institutions engage with digital assets, giving banks a clearer regulatory pathway to offer crypto-related services without taking on large balance-sheet exposure.

What the OCC actually approved

In Interpretive Letter 1188, published on December 9, the OCC formally stated that national banks may facilitate cryptocurrency transactions by acting as an intermediary between two customers. Under this arrangement, the bank can:

– Temporarily purchase a digital asset from one client

– Immediately resell that asset to another client

– Ensure that the two trades fully offset each other

Because the purchase and sale occur almost instantly and in matched amounts, the bank does not hold the asset for any meaningful period, nor does it maintain ongoing exposure to price movements.

The OCC defines these riskless principal trades as essentially low-risk activities, aligning them with familiar brokerage practices already permitted in the traditional financial system.

Why the “riskless principal” model matters

In the riskless principal framework:

– The bank does not build a speculative crypto inventory

– Market and price risk are kept to a minimum

– The institution mainly earns a spread or fee for arranging the trade

This model allows banks to serve as intermediaries between buyers and sellers while avoiding many of the heightened capital and volatility concerns that come with holding digital assets on their own balance sheets.

For regulators, this is a crucial distinction. It provides a way for banks to support crypto activity in a more controlled, standardized manner, rather than acting like trading desks or hedge funds that actively manage positions.

Technology-neutral regulation as a guiding principle

The OCC has repeatedly emphasized that financial activities should be supervised based on the nature and level of risk, not the type of technology involved. In its letter, the agency stresses that crypto intermediation under a riskless principal structure is functionally comparable to long-established securities intermediation.

In other words, if a bank is already permitted to intermediate bond or stock trades using a similar model, the OCC sees no reason to treat the same mechanism differently just because the underlying asset is a cryptocurrency. This is part of a broader “technology-neutral” approach, where regulation focuses on:

– Operational risk

– Market risk

– Compliance and legal risk

– Consumer protection

rather than on whether an asset is digital or traditional.

Conditions and safeguards for banks

While the OCC has authorized these activities, the green light comes with clear expectations. Any national bank looking to intermediate crypto transactions must implement strong controls and governance.

Key requirements highlighted by the agency include:

– Robust risk management: Banks must identify, measure, monitor, and control the specific risks arising from digital asset intermediation, including operational, cybersecurity, liquidity, and counterparty risks.

– Customer protections: Institutions must ensure clear disclosures, fair dealing, and proper handling of client instructions, mirroring standards in other markets.

– Compliance frameworks: Banks need effective systems to comply with anti-money laundering rules, sanctions regimes, know-your-customer requirements, and other relevant regulations.

– Safe operational processes: Technology infrastructure, custody arrangements, transaction routing, and settlement processes must be resilient, secure, and well-documented.

The OCC also made clear that these activities will be reviewed through normal supervisory channels. Bank examiners will evaluate whether crypto-related services are consistent with the institution’s overall risk profile and whether they meet the same safety and soundness standards applied elsewhere in the banking business.

Part of a broader regulatory shift in 2025

This interpretive letter does not exist in isolation. It follows a series of changes in how U.S. regulators view banks engaging with digital assets.

Throughout 2025, the OCC, the Federal Reserve, and the Federal Deposit Insurance Corporation have rolled back or revised earlier statements that were widely perceived as discouraging banks from offering crypto services. Those earlier documents had created uncertainty, causing many institutions to either pause or limit their digital asset initiatives.

By withdrawing or softening those restrictive positions, and now offering explicit guidance on riskless principal crypto trades, regulators signal a willingness to incorporate digital assets into the regulated banking framework rather than keeping them at arm’s length.

What this means for traditional finance

For traditional financial institutions, the OCC’s guidance provides three key opportunities:

1. A clearer legal path into crypto markets

Banks now have explicit confirmation that they can intermediate crypto trades in a way that is already familiar from securities markets. This reduces legal ambiguity and internal compliance friction for launching or scaling such services.

2. The ability to serve institutional demand

Institutional investors, corporations, and high-net-worth clients increasingly want access to digital assets but prefer to work within familiar, regulated banking channels. By offering riskless principal crypto trading, banks can respond to this demand without drastically changing their risk profiles.

3. Stronger integration between “TradFi” and digital assets

Once banks can reliably intermediate trades, it becomes easier to build additional services around that capability, such as structured products referencing crypto, payment rails that use digital assets, or tokenized versions of traditional instruments.

Potential benefits for customers and the crypto ecosystem

For clients, the OCC’s decision could lead to:

– More trusted counterparties: Many customers may feel more comfortable trading crypto through a regulated bank they already know rather than a purely digital-native platform.

– Improved market structure: With banks intermediating trades, there may be more standardized processes around execution quality, reporting, and settlement.

– Better integration with existing accounts: Over time, customers could see crypto transactions and traditional holdings managed under a single banking relationship, which can simplify accounting and portfolio oversight.

For the broader crypto ecosystem, the move may:

– Encourage more institutional participation

– Increase demand for compliant custody and infrastructure

– Accelerate the convergence of traditional and decentralized finance models

Remaining constraints and unanswered questions

Despite the new flexibility, banks will still proceed cautiously. Several practical and strategic questions remain:

– Profitability vs. risk: Riskless principal models generate relatively modest margins compared with proprietary trading. Banks will need scale and efficient infrastructure to make these services commercially attractive.

– Counterparty risk and liquidity: Even in “riskless” setups, execution timing, market fragmentation, and exchange reliability can introduce operational and settlement risk.

– Choice of crypto assets: Not all digital assets are likely to be treated equally. Many banks will start with the most established cryptocurrencies and stablecoins, particularly those with clearer regulatory treatment.

– Interplay with future legislation: Ongoing debates around digital asset laws, stablecoin frameworks, and potential central bank digital currencies could further reshape what banks can and cannot do in this space.

How banks might implement crypto intermediation in practice

In operational terms, a bank entering this market could:

1. Connect to one or more regulated crypto trading venues or liquidity providers.

2. Receive client orders to buy or sell specific digital assets.

3. Execute a purchase from a seller and a sale to a buyer so that the bank’s position nets to zero.

4. Settle the cryptocurrency to or from an approved custody arrangement, while cash legs move through traditional payment systems.

Over time, banks may build internal trading engines, smart order routing systems, and integrated risk dashboards that treat crypto alongside foreign exchange, equities, and fixed income exposures—while still keeping the positions matched and short-lived to stay within the riskless principal framework.

Impact on competition with crypto-native platforms

Crypto-native exchanges and brokerages will face new competition from traditional banks. However, the effect is unlikely to be one-sided:

– Banks’ advantages: Brand trust, deep compliance expertise, established client relationships, and access to cheap funding.

– Crypto-native firms’ strengths: Product innovation, faster iteration cycles, broader asset coverage, and deeper roots in decentralized ecosystems.

Rather than replacing existing platforms, banks may initially focus on clients who were hesitant to enter crypto markets until they could do so through regulated institutions. Collaboration is also possible, with banks relying on specialized crypto firms for technology, liquidity, or custody behind the scenes.

A step toward normalized digital asset regulation

Taken together, the OCC’s interpretive letter and the broader regulatory adjustments of 2025 show a gradual normalization of digital assets in the U.S. financial system. Crypto is being treated less as an outlier and more as another asset class that needs clear rules, defined responsibilities, and robust oversight.

By allowing national banks to intermediate crypto transactions on a riskless principal basis, regulators are:

– Providing a controlled entry point for banks into digital assets

– Preserving the core safety-and-soundness framework of the banking sector

– Responding to market demand for regulated crypto infrastructure

How quickly banks move will depend on their risk appetite, technology readiness, and client interest. But the regulatory foundation is now stronger—and that alone marks a significant shift in the relationship between U.S. banking and cryptocurrency.