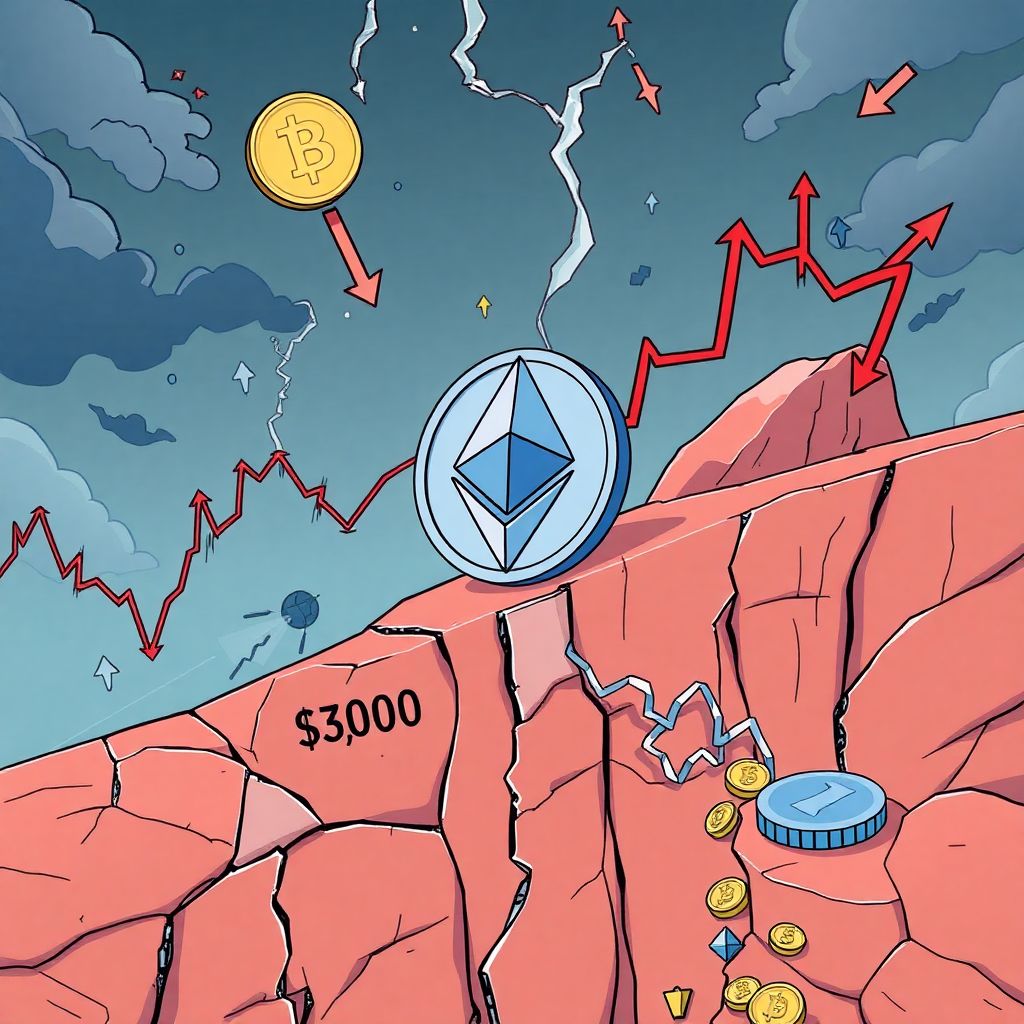

Ethereum Rebounds to $3K Amid ETF Outflows: Are Bulls Walking Into a Trap?

After dipping to the critical $3,000 level, Ethereum (ETH) has staged a modest recovery, climbing approximately 3.5%. However, this rebound comes in the face of sustained capital outflows from Ethereum ETFs and signs of weakening conviction among large investors. The central question for traders and investors now is whether this bounce signifies the start of a sustained upward trend—or simply a deceptive bull trap reminiscent of earlier breakdowns.

Market Sentiment Turns Cautious Despite Price Lift

Despite the recent price uptick, Ethereum’s technical structure remains fragile. The cryptocurrency continues to display a bearish chart pattern, lacking the hallmark V-shaped recoveries that typically signal strong buy-side conviction. Since October, ETH has formed a series of lower highs and lower lows, suggesting that downward momentum still dominates.

Adding to this sense of caution, a prominent Ethereum whale recently moved 3,000 ETH—equivalent to roughly $9.5 million—back to Binance after holding for over six weeks. The move resulted in a realized loss of nearly $7 million, underscoring the ongoing capitulation from smart money. This behavior contrasts sharply with the accumulation that usually supports sustainable rallies.

ETF Outflows Undermine Confidence

Ethereum exchange-traded funds (ETFs) have also painted a concerning picture. Over the past two weeks, only two days have recorded net inflows. The rest have seen consistent outflows, draining millions from these investment vehicles. ETFs are often viewed as a proxy for institutional confidence, and their poor performance suggests that larger players are pulling back rather than doubling down.

This trend has heightened selling pressure and may be contributing to Ethereum’s inability to establish a stable support level above $3,500—let alone break toward new highs.

Rotation From Bitcoin to Ethereum: A Silver Lining?

Despite the bearish overtones, there are emerging signs of strategic capital rotation in the market. As Bitcoin dominance struggles to break above 60%, Ethereum’s market share has climbed back above 12%, supported by three consecutive days of net inflows. This shift suggests that traders are reallocating capital from BTC to ETH, viewing the latter as a more favorable risk-to-reward play in the current climate.

The ETH/BTC ratio has risen by roughly 3% over a 72-hour span, rebounding from the 0.032 level. This indicates a broader trend of capital rotating into altcoins, with Ethereum being the primary beneficiary.

Derivatives Market Suggests Strong Long Bias

The derivatives landscape further supports the notion of a bullish tilt among traders. On Binance, the ETH/USDT perpetual contracts show a significant long bias, with over 70% of positions favoring upward price movement across various timeframes.

Open Interest (OI) in Ethereum futures has surged by $2 billion in less than three days—a rate of growth seven times faster than that of Bitcoin. This rapid build-up in leveraged positions suggests that traders are betting aggressively on a continued price increase.

However, this exuberance might be premature. High leverage levels can amplify both gains and losses, and if Ethereum fails to push higher, the market could face a cascade of liquidations, reinforcing bearish momentum.

A Technical Trap in the Making?

From a structural perspective, Ethereum’s current price action bears a striking resemblance to its mid-November breakdown. Just like then, the $3,000 support level is attracting late long positions, creating the risk of a momentum failure and subsequent sharp sell-off.

The inability of bulls to hold $3.5K earlier this month has left many traders wary. Now, with ETH hovering around $3K again, the market is at a critical inflection point. If Ethereum fails to build upon this bounce with increased volume and stronger fundamentals, it may be setting the stage for another downward leg.

What’s Next for ETH? Key Levels and Factors to Watch

Looking ahead, several technical and fundamental markers could help determine Ethereum’s next move:

– Support at $3,000: This psychological level must hold. A breakdown below it could catalyze a rapid sell-off toward $2,800 or even $2,500.

– Resistance near $3,500: ETH must reclaim and maintain this level to confirm a trend reversal and invalidate the bear case.

– ETF inflows: Watch whether institutional capital begins to return. Sustained inflows could be a bullish confirmation.

– Whale activity: Continued selling by large holders would indicate ongoing fear, while renewed accumulation could signal a bottom.

– Macro sentiment: Broader market conditions, including interest rate expectations and risk appetite, will also influence ETH’s trajectory.

Ethereum’s On-Chain Signals: Mixed Bag

While technicals and derivatives paint a complex picture, on-chain data provides some additional context. Network activity, including daily active addresses and transaction volumes, has seen only modest growth, suggesting that retail participation remains tentative. Staking metrics, however, continue to improve, indicating growing long-term confidence among certain segments of the investor base.

Additionally, gas fees have remained relatively stable, which may support adoption and broader use-case development, particularly in DeFi and NFT ecosystems.

Ethereum 2.0 and Long-Term Fundamentals

It’s also worth considering Ethereum’s long-term outlook. The network’s transition to proof-of-stake via Ethereum 2.0 has significantly reduced energy consumption and introduced staking rewards for validators. These changes are reshaping the supply-demand dynamics of ETH.

Over time, reduced issuance and increased staking could create deflationary pressure, especially if network activity accelerates. However, these fundamental tailwinds may take months to materialize in price action and are unlikely to offset short-term bearish momentum without corresponding improvements in sentiment and capital flows.

Conclusion: Proceed with Caution

Ethereum’s recent bounce to $3,000 offers a glimmer of hope, but significant risks remain. The lack of strong technical confirmation, ongoing ETF outflows, and smart money capitulation all point to a fragile recovery that could quickly unravel.

Bulls may be stepping into a trap if they ignore these warning signs. Until Ethereum can break above key resistance levels with conviction and attract sustained capital inflows, caution is the prudent approach. Traders and investors should closely monitor leverage metrics, ETF flows, and whale behavior to gauge the strength of any potential breakout—or brace for another leg down.