Chainlink’s recent market performance has sparked concern among investors, as the token continues its downward trajectory, breaking through vital long-term support levels. The latest breach of the $15.44 level marks a significant shift in LINK’s price structure, signaling further weakness ahead unless bulls can reclaim lost ground.

Over the past few weeks, LINK has failed to maintain momentum, despite positive on-chain developments and partnerships with traditional finance institutions. The most recent weekly candle closed at $13.73, confirming a fall below two crucial supports at $15.44 and $14.56. The latter corresponds to a key Fibonacci retracement level, derived from the earlier rally that took LINK from $10.94 to $27.87, adding weight to its importance.

This breakdown has flipped Chainlink’s higher-timeframe market structure to bearish. The breach of $15.44 wasn’t just a technical failure—it also indicated a loss of control by bulls at a historically significant level. Additionally, the $14.56 level, once defended as a strong retracement zone, has now been surrendered, emphasizing the increasing dominance of sellers.

Despite a 100% surge in daily trading volume, the momentum has failed to translate into meaningful price recovery. On November 17, LINK was up by 2.91% intraday, trading at $14.13, while Bitcoin also saw a modest 1.95% increase. However, these gains occurred in an overall bearish context, lacking the support of broader market optimism.

A deeper dive into volume dynamics reveals that the On-Balance Volume (OBV) indicator has been steadily declining, reflecting sustained selling pressure. This persistent downward volume trend suggests that any short-term bounce is more likely to be met with selling rather than a sustainable reversal.

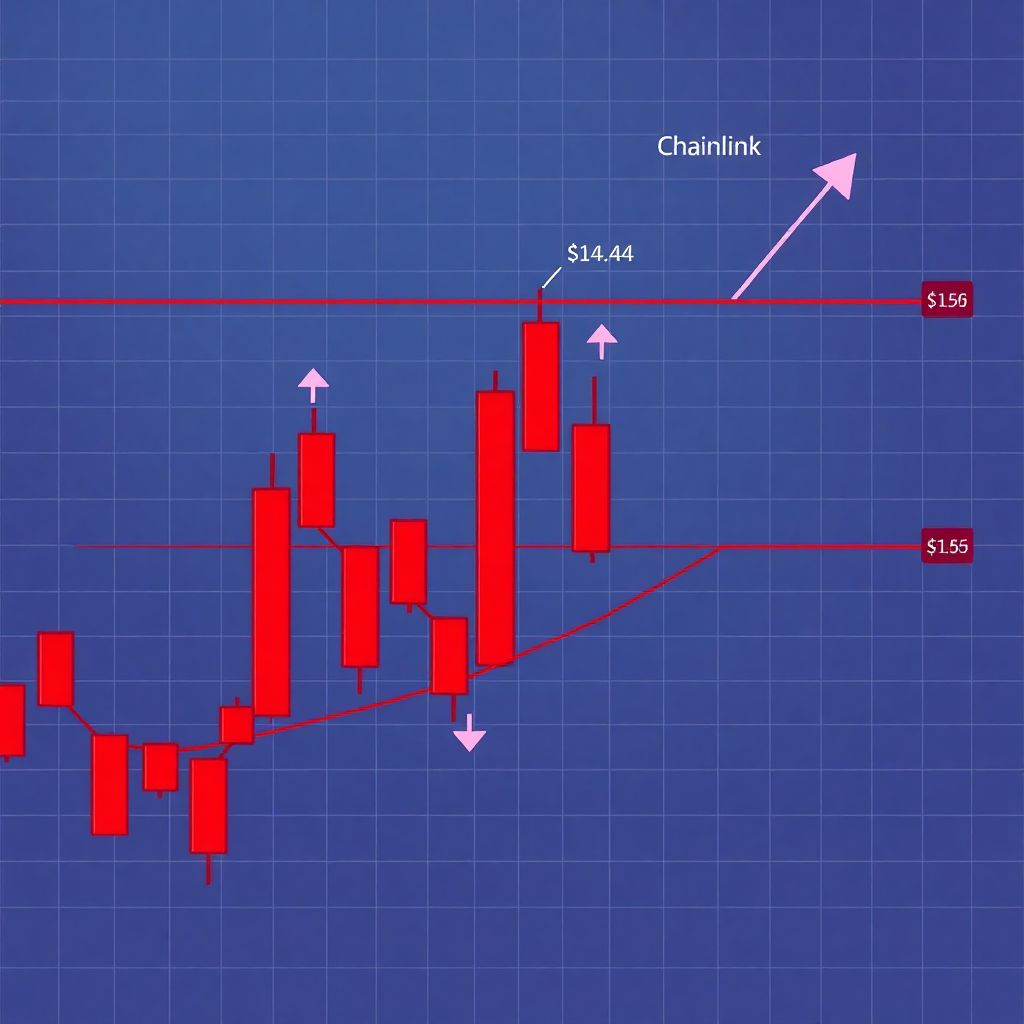

Technically, any price move toward the $15–$16.6 range is likely to encounter heavy resistance. This zone, identified as a bearish order block on the daily chart, represents a supply area where sellers have previously overwhelmed buyers. Thus, even if LINK attempts a relief rally, the token is expected to face significant rejection near this region.

Looking ahead, the next immediate supports lie at $12.70—a level dating back to July—and $10.94, which marks the bottom of the earlier bullish swing. If current bearish momentum continues, these price points could serve as potential areas for short-term consolidation or further downside targets.

The situation is particularly intriguing given that on-chain metrics have indicated accumulation by long-term holders. Normally, this would be seen as a bullish sign, but in this case, the bearish price action suggests that accumulation alone is insufficient to counteract broader market pessimism. External macroeconomic factors and a lack of retail participation may also be contributing to the subdued sentiment.

Traders should exercise caution in the current environment. Short-term bounces may present opportunities for short-selling rather than long positions, as bearish momentum remains intact. The loss of trend-defining supports and the inability of bulls to reclaim them suggest that any rallies will likely be corrective rather than trend-changing.

From a broader perspective, this price action reflects a classic bearish market cycle phase in which sentiment remains weak, despite fundamentally strong developments. Chainlink’s continued integration into real-world finance and the growth of its decentralized oracle network may eventually provide support. However, in the near term, price action is likely to remain under pressure.

For investors considering entry points, patience is key. Waiting for confirmation of a reversal—such as a reclaim of the $15.44 level on strong volume—would offer a more favorable risk-reward setup. Conversely, aggressive traders might look to short failed rallies near resistance levels, particularly within the $15–$16.6 supply zone.

Additionally, monitoring Bitcoin’s performance is essential, as broader market sentiment often hinges on BTC’s direction. If Bitcoin begins a new bullish phase, it could offer tailwinds for altcoins like LINK. However, as of now, the lack of strong upward momentum from BTC does little to inspire confidence in a LINK recovery.

In summary, Chainlink is currently navigating a bearish landscape, marked by the loss of critical supports and persistent selling pressure. While the fundamentals remain promising in the long term, technical indicators and price structure suggest that caution is warranted in the short to mid-term. Traders and investors alike should remain vigilant, aligning their strategies with the prevailing market trend and awaiting clearer signals of reversal before making significant moves.