Category: Optimized Tax Strategies

-

Vanguard’s crypto u‑turn: new era for bitcoin, ethereum and Xrp etfs

Morning Minute: Vanguard’s Crypto U‑Turn Signals a New Phase for Digital Assets Vanguard, long regarded as one of Wall Street’s staunchest skeptics of digital assets, has just made a dramatic pivot: the $9 trillion asset management giant is finally allowing its clients to buy crypto-related ETFs through their standard brokerage accounts. For years, Vanguard drew…

-

Crypto fraud recovery: how victims now reclaim stolen crypto with blockchain forensics

Crypto fraud victims are beginning to reclaim a far larger share of their stolen assets as advanced blockchain forensics, tighter exchange compliance and record-breaking government seizures change what is realistically recoverable. Where a few years ago most industry players treated hacked or scammed crypto as permanently lost, recent cases suggest that narrative is rapidly becoming…

-

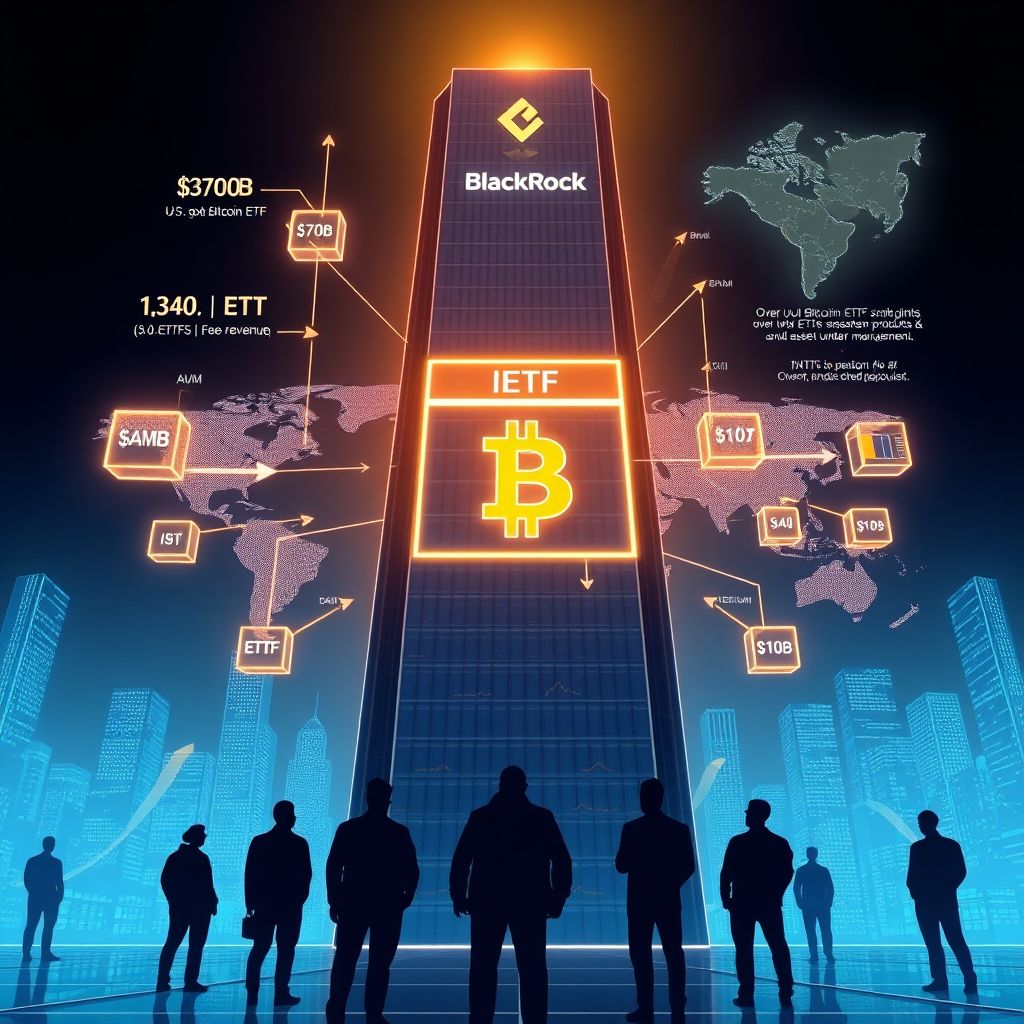

Blackrock bitcoin Etf emerges as crown jewel and top profit engine

BlackRock’s Bitcoin ETF Becomes Crown Jewel of Its Product Suite BlackRock’s flagship U.S. spot Bitcoin ETF has rapidly moved from a bold experiment to the firm’s most lucrative business line, reshaping both its internal revenue mix and the broader landscape for institutional crypto investments. Launched in January 2024, the U.S.-listed fund accumulated around $70 billion…

-

Bitcoin monthly Macd turns bearish as macro headwinds hit liquidity and sentiment

Bitcoin’s monthly MACD flips bearish as macro headwinds hit liquidity and sentiment Bitcoin’s long-term momentum gauge has turned negative again, reinforcing fears that the latest sell-off could be more than a brief correction and instead the start of a deeper downtrend across crypto. On the monthly chart, Bitcoin’s Moving Average Convergence Divergence (MACD) indicator has…

-

Fed’s michelle bowman backs stricter stablecoin rules to align banks and crypto

Fed Governor Michelle Bowman is heading to Capitol Hill with a clear message for both Wall Street and the crypto industry: traditional banks and digital asset firms can coexist, but only under stricter, consistently enforced rules. In prepared testimony for a House Financial Services Committee hearing, Bowman plans to urge lawmakers to tighten oversight of…

-

Dogecoin whales retreat as on-chain activity drops, putting Doge rally at risk

Dogecoin whales are stepping back from the market, and that sudden quiet is making traders question whether the meme coin still has much strength behind its moves. Fresh on-chain data shared by cryptocurrency analyst Ali Martinez on Sunday, Nov. 30, shows that large-holder activity in Dogecoin has fallen to its lowest level in about two…

-

Gold nears record high as bitcoin and global stocks slide amid risk‑off shift

Gold is marching back toward record territory even as Bitcoin and global equities sink, underscoring a sharp shift in risk appetite as traders brace for changing central bank policy and mounting macroeconomic uncertainty. On Monday, gold futures climbed close to 1%, extending a steady advance through November. Contracts are changing hands around $4,262 per ounce,…

-

Altcoin liquidity evaporates as bitcoin etfs and treasuries reshape crypto markets

Altcoin liquidity is evaporating as capital crowds into Bitcoin-centric products, reshaping the structure of the crypto market and leaving most smaller tokens increasingly fragile. According to analysis from CryptoQuant’s CEO, trading depth and activity across the altcoin sector have been steadily eroding for months. Order books are thinning, daily volumes are sliding, and the gap…

-

Btc nears $100,000 as mint miner touts $7,700 daily cloud mining returns

BTC targets $100,000 as Mint Miner touts $7,700 daily returns in a turbulent market As Bitcoin (BTC) violently oscillates around the $90,000 mark and macroeconomic risk continues to climb, the narrative in crypto is shifting. Instead of chasing speculative price spikes, more investors are searching for “real yield” – returns backed by verifiable infrastructure rather…

-

Japan to introduce 20% flat tax on cryptocurrencies from 2026

Japan is preparing a major overhaul of how it taxes cryptocurrencies, moving to treat digital assets much more like traditional securities. From 2026, the government plans to introduce a unified 20% tax on profits from crypto trading, mirroring the rate already applied to stocks and investment trusts. Under the upcoming framework, income from cryptocurrency transactions…