Crypto’s UX crisis: why billions of people still aren’t here

The hard truth is simple: crypto is not losing because the technology is weak. It’s losing because the experience of using it is hostile to normal people. For all the talk about decentralization, sovereignty, and “web3 revolutions,” crypto still hasn’t broken into daily life for the majority.

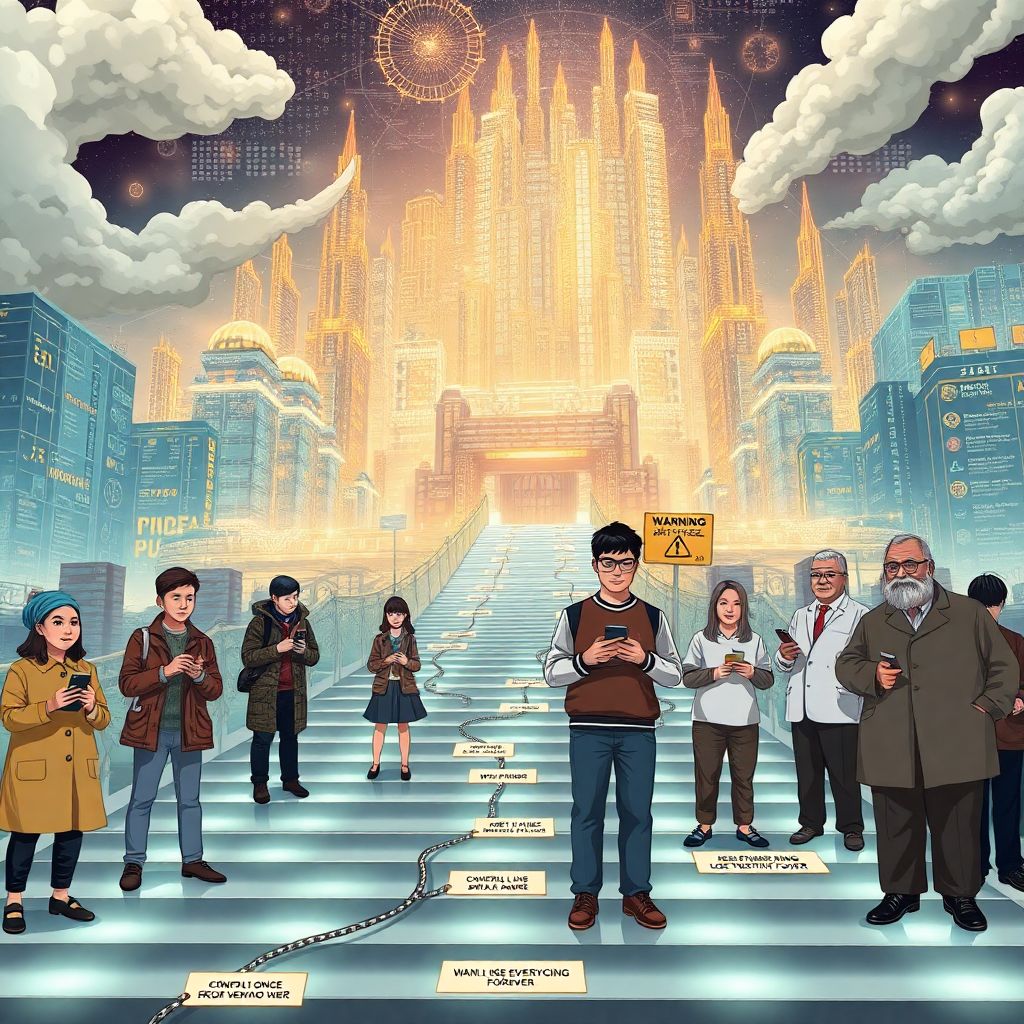

We’ve created dazzling, intricate architectures — chains, rollups, bridges, exotic token models — that impress engineers and insiders. But to everyone else, they look like locked fortresses with instructions written in a foreign language. The mythical “next billion users” never arrive, not because they’re indifferent to financial freedom, but because we’ve made entry feel like passing a technical exam.

Crypto today largely talks to itself. New layer-2 solutions launch every month, chains fork, tokenomics are endlessly tweaked. Inside the echo chamber, this feels like progress. Outside of it, the average person still sees crypto as confusing, risky, or unusable. Meanwhile, real-world demand for better money is enormous: cheaper remittances, protection from inflation, permissionless access to global markets. Instead of solving those problems in a human way, we often build complex puzzles that only a narrow slice of users can solve.

If this doesn’t change, crypto risks becoming the financial equivalent of early QWERTY smartphones: technically impressive, beloved by a tiny minority, and ultimately displaced by simpler, more intuitive designs. The danger isn’t just regulation or market cycles. The real existential threat is irrelevance.

The onboarding obstacle course

Try to see web3 through the eyes of someone completely new. Onboarding usually looks like this:

– First, they’re told to “get a wallet.” Then they must choose: custodial or noncustodial, browser extension or mobile, hardware or software.

– Next comes the avalanche of jargon: L1s vs. L2s, bridges, rollups, mainnets, testnets.

– They’re asked to write down a 12- or 24-word seed phrase “or lose everything forever.”

– To do anything at all, they must acquire a specific chain’s native token to pay gas — which they don’t yet own and don’t understand.

– Transactions fail for mysterious reasons: “insufficient gas,” “slippage too high,” or some obscure error code.

– Then someone suggests “just check Etherscan,” as if parsing raw transaction data were self-explanatory.

This isn’t onboarding. It’s hazing.

The language, the flow, even the visual design of many applications signal that these tools are made by and for developers. Interfaces feel less like consumer products and more like debugging consoles. For people used to one-tap payments, auto-filled forms, and polished mobile banking, this is jarring.

Web3 claims to democratize ownership and finance, but it demands that users grasp seed phrases, custody models, gas markets, slippage, RPC endpoints, and governance mechanisms before they can do even the simplest action. The contradiction is obvious: empowerment that requires expert-level knowledge isn’t empowerment — it’s exclusion.

Ten years in — and still a niche

Various studies estimate that around 5% of the global population has some exposure to crypto assets. On paper, that’s hundreds of millions of people. In practice, the majority are early adopters: developers, traders, speculators, and technically inclined users. For them, the promise of programmable money and digital ownership is already real.

But we are now more than a decade into this experiment. We’ve been told, repeatedly, that “mass adoption is just around the corner”:

– During the ICO mania of 2017

– During the DeFi boom in 2020

– In the waves of memecoins and NFT hype

– With the rise of stablecoins, compliance layers, and institutional interest

– Now again with AI agents and “autonomous” crypto-native systems

And yet, supermarkets aren’t settling invoices on-chain, migrant workers still pay painful remittance fees, and most people’s savings remain trapped in fragile, inflation-prone local currencies. The tools exist, but they are too hard to use. The industry primarily builds for itself, then wonders why “regular users” don’t show up.

The attention deficit we refuse to acknowledge

We live in an age shaped by ultra-short attention spans. Platforms condition users to make decisions in seconds. Data suggests that for an average consumer app, only about a third of users come back within a day after first use. After a week, that number sinks to low double digits. And that’s for apps with smooth onboarding and intuitive flows.

Now compare that to a typical crypto app:

– You install a wallet and see… an empty screen.

– There is no guided walkthrough, no obvious “do this next” path.

– Funding the wallet is your problem. Understanding security is your problem.

– If something goes wrong, the consequences are permanent — with no recourse.

Most people simply leave at the first sign of friction. Crypto UX often assumes users will push through confusion out of ideological conviction. They won’t. They have other options — traditional banks, fintech apps, mobile money services — that may be imperfect, but at least they are comprehensible.

This is not a minor detail. In consumer technology, superior user experience almost always beats superior ideology. History is full of technically better systems losing to simpler ones. If crypto wants to be infrastructure for billions, it must be more than correct — it must be comfortable.

The gap between promise and reality

Globally, people are desperate for better financial rails. In many countries, inflation quietly erodes savings. Cross-border transfers still cost a painful percentage of low-income workers’ wages. Even the global benchmark currency has shown its vulnerabilities, losing significant value over recent years.

Crypto could, in theory, provide a resilient alternative: programmable money that moves at internet speed, borderless savings that resist local crises, open access to financial products without gatekeepers. But that lifeline is currently wrapped in technical jargon, scattered across incompatible wallets, and hidden behind risky UX patterns that punish mistakes harshly.

Web3 loves the language of sovereignty — “not your keys, not your coins,” control your data, own your identity. But sovereignty without usability easily morphs into a new type of tyranny. When one wrong click can wipe out your funds, and when recovery options barely exist, the psychological burden is enormous. Shifting 100% of the risk onto users is not liberation; it’s abandonment.

What web2 got right — and web3 keeps ignoring

Look at mainstream payment apps: Apple Pay, Venmo, Revolut, local neobanks. These tools succeed not because people study their underlying infrastructure, but because the surface is simple and forgiving.

– Onboarding takes minutes, sometimes seconds.

– Interfaces focus on outcomes: “Send,” “Request,” “Save,” not “broadcast transaction” or “sign message.”

– Complexities like fraud detection, settlement, or identity verification are hidden behind elegant flows.

– Account recovery is normal. Biometric authentication is standard. Users feel that if something goes wrong, someone can help.

It’s not that users don’t care about ownership or privacy. It’s that they don’t want to become part-time security engineers or protocol researchers just to pay a friend back or protect their savings. Crypto will not win by lecturing them that “freedom is hard.” It will win only when freedom feels easy.

Designing crypto for humans, not hackers

If we want crypto to matter beyond speculation, we must invert our priorities and design from the outside in. That means starting with real people and real problems, then deciding how much of the crypto stack to reveal — and how much to hide.

A human-centered web3 product should:

– Lead with familiar language: “Send money,” “Protect savings,” “Pay abroad,” instead of “swap,” “stake,” or “add liquidity.”

– Offer clear, guided first actions: fund the wallet, try a tiny test transaction, set up simple backups.

– Provide context at every step: what this action does, what can go wrong, and how to undo or recover.

– Collapse choices wherever possible: users shouldn’t need to pick from 20 networks or bridges to do one thing.

The core question for every feature should be: would someone who has never used crypto before understand what to do within 10 seconds? If the answer is no, the design is not ready for mass adoption.

Abstraction is not the enemy — it’s the bridge

In many crypto circles, abstraction and custodial experiences are treated with suspicion. The mantra is that users must “hold their own keys” and “feel the full responsibility” of self-sovereignty. But absolute purity is a luxury only power users can afford.

For billions of people, some level of managed experience is not a compromise — it’s a requirement. Good UX doesn’t erase sovereignty; it layers it. For example:

– Start with simple account recovery through email, devices, or social verification, then gradually introduce more advanced security for users who want it.

– Use smart contract wallets that allow programmable permissions, daily limits, and time-locked withdrawals to protect against irreversible mistakes.

– Abstract networks and gas fees, letting users interact with one “balance” while the app routes transactions optimally behind the scenes.

The user should be able to enjoy the benefits of decentralization without first learning its entire vocabulary. They don’t care whether it’s an L1, L2, appchain, or sidechain. They care that their transaction is fast, cheap, and reliable — and that they can get their money back if they lose their phone.

Security that doesn’t feel like a trap

Security is where crypto UX often becomes brutal. One wrong click on a phishing site, one misplaced seed phrase, and everything is gone forever. That kind of all-or-nothing environment is unbearable for the average person.

We need safety nets that reflect how humans actually behave:

– Progressive security: low amounts can be easily moved and recovered, while higher amounts require stronger checks.

– Clear warnings: visually distinct interfaces for signing transactions, with human-readable explanations of what you’re agreeing to.

– Reversibility where possible: time delays for large transfers, emergency “pause” functions on smart wallets that users can trigger if they suspect a compromise.

Traditional finance has chargebacks and fraud desks. Web3 can’t copy those exactly without sacrificing decentralization, but it can build new, protocol-native forms of recourse. A world where one typo in an address burns a family’s savings is not a world that mass markets will embrace.

Education must be embedded, not external

Another common mistake is to treat education as something separate from the product: long articles, technical docs, explainer videos. Useful, but most users will never see them. Education must be woven directly into the experience:

– Contextual tips that appear at the exact moment a user needs them.

– Simple simulations that let people “practice” sending or swapping with fake amounts before using real funds.

– Plain-language summaries of what a protocol does, not just its token symbol and APR.

Think of UX as a continuous, built-in tutorial, not a one-time setup. The more complex the underlying system, the more invisible and intuitive the surface must be.

Build for outcomes, not for protocols

The average person does not look for “a DeFi protocol.” They look for:

– A way to save in a more stable currency than their own

– A cheaper way to send money home

– A method to protect earnings from local political or banking risk

– A chance to access investments normally reserved for the wealthy

If crypto wants to serve these needs, products must be framed around outcomes, not infrastructure. The protocol is the backend. The frontend is a promise: “Keep your money safe from inflation,” “Move your salary anywhere instantly,” “Get paid globally without a bank.”

Teams that truly focus on these promises will naturally reduce steps, remove jargon, and implement flows that highlight value instead of complexity. The rest will keep building beautiful, unused machinery.

The choice: relevance or purity

Crypto stands at a crossroads. It can cling to ideological purity, demanding that every user accept maximum responsibility, learn the deepest layers of the stack, and operate like a power user from day one. Or it can accept that real empowerment requires comfort, clarity, and safety — not just control.

Mass adoption will not happen because regulators approve, institutions allocate, or markets pump. It will happen when a person who has never heard the word “blockchain” can download an app, understand its purpose in seconds, complete a meaningful action in minutes, and feel confident they won’t lose everything if they make a mistake.

Until the industry designs for that person, crypto will remain what it largely is today: a brilliant, experimental, self-referential playground. If we want it to become everyday infrastructure — the financial layer of the internet — then UX is not a secondary concern. It is the battlefield. And right now, we are losing.